Asset Protection Strategies

Please review some asset protection strategies that you may want to use with one of your Wyoming Limited Liability Companies or Wyoming Corporations. The following is an example for educational purposes. Discussing strategies is something we recommend you do with your financial planner. See more helpful info here.

Dual Corporation Strategy

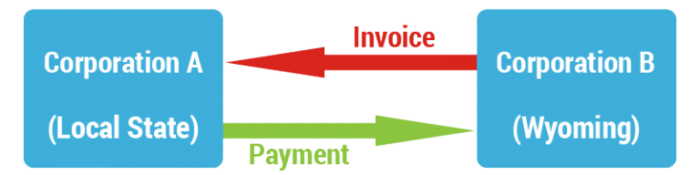

In the dual corporation strategy, Corporation A is started in your local state to do business with the public. Corporation B is a Wyoming corporation which invoices Corporation A for a monthly consulting fee.

The advantage of this strategy is that state taxes can be minimized in your home (local) state by paying submitting profits as payments to Corporation B by the end of the year. If anyone brings a lawsuit against Corporation A , only the assets of Corporation A are at risk. This is a great advantage for you.

Intellectual Property Holding Company

In an Intellectual Property Holding Company (IPHC), the intellectual property—whether it be patents, copyrights, recipes, or other valuable information—is held in a Wyoming company at arm’s length from the operating company (in your home state), which deals with the public. In the event of a lawsuit, the operating company in the local state is sued, and only its assets are at risk, while the IPHC remains unencumbered by the lawsuit, and may even license its intellectual property to a new company.

Equity Stripping

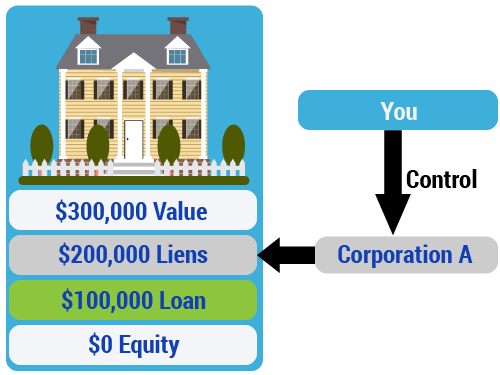

Equity stripping is an easy way to protect real estate, and can also improve cash flow at the same time.